Nothing kills excitement faster than figuring out how to get paid. You land a big client, the project’s ready to go, and then comes the dreaded question: “How would you like to receive payment?”

Suddenly, the deal feels at risk. Local banks won’t work. PayPal isn’t available everywhere. And every “solution” you find looks shady or expensive.

I’ve been there…stressed, scrambling, and almost losing a client because of payments. That’s when Payoneer saved me. Fast to set up, legit, and trusted worldwide.

In this guide, I’ll show you how it works, what it costs, and why it’s worth it.

What Is Payoneer and How Does It Work?

It is a global payment platform that makes it easy to send and receive money across borders. Think of it as your digital business account for international clients.

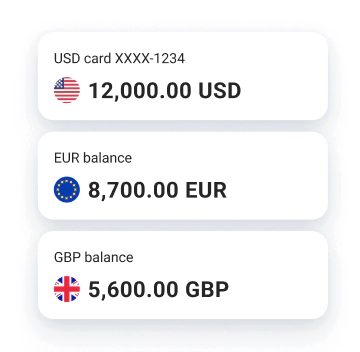

Instead of worrying about whether your local bank or PayPal will work, you get a secure, trusted way to get paid in multiple currencies.

When you open an account, you’re essentially creating an online wallet. Your clients can pay you just like they would pay any local vendor.

The money shows up in your balance, and from there, you can withdraw it to your bank account, spend it online, or transfer it to another user.

Here’s how this works step by step:

- Sign up for a free account and verify your details.

- Receive payments from clients, marketplaces (like Upwork, Fiverr, Amazon), or directly from businesses worldwide.

- Hold funds in your account in different currencies (USD, EUR, GBP, and more).

- Withdraw to your bank in local currency or use the card (if available in your country) to spend directly.

2. How to Create, Open, and Log Into a Payoneer Account?

How to Create a Payoneer Account

Getting started with Payoneer is simple and free. Here’s how to do it:

- Visit the Payoneer website and click Sign Up.

- Choose the type of account — personal or business.

- Enter your personal details: full name, email, date of birth, and address.

- Provide your bank account information for withdrawals.

- Verify your identity with an ID document.

Once approved, your account is ready to use.

How to Open a Payoneer Account Successfully

Many freelancers get stuck during the approval process. To avoid delays:

- Use your legal name exactly as it appears on your ID.

- Provide accurate banking details (matching your account name).

- Double-check that your email and phone number are active and accessible.

This ensures your account opens smoothly without rejection.

How to Log In to My Payoneer Account

Once your account is active:

- Go to the Payoneer login page.

- Enter your registered email and password.

- Complete two-factor authentication (if enabled).

- Access your dashboard to check balances, receive payments, and withdraw funds.

Does Payoneer Charge a Fee? Complete Fee Breakdown

Yes. Payoneer does charge fees. The good news: many are transparent, and some are avoidable depending on how you use it. Below is a breakdown, with current rates and examples. Always double-check in your Payoneer dashboard for your country.

Account / Annual Fee

- If your account receives less than USD 2,000 (or equivalent) in a 12-month period, Payoneer may charge an annual inactivity fee of $29.95.

- If you’re active (above that threshold), you often won’t face this fee.

Receiving Payments

- Receiving payments from other Payoneer users: typically free.

- Receiving from marketplaces or companies (Global Payment Service): it may charge up to 1% (minimum $4) for cross-border payments.

- If the currency is different (e.g. you receive USD but your “home” is in another currency), you may incur conversion-related fees. For example, it states a cross-border / currency conversion fee up to 3.5% in some cases.

Source: Payoneer Fees

Withdrawing to Your Bank Account

- If your balance and your bank account are in the same currency and country, there is a fixed fee of $1.50 / €1.50 / £1.50 for withdrawals.

- If withdrawing to a bank account in a different currency, Payoneer may apply a fee of up to 2% on top of the conversion.

- For “foreign currency withdrawals” (e.g. USD → local currency), Payoneer may take 2–3.5% margin on top of market exchange rate.

Example: If you have USD in your Payoneer balance and want to withdraw to a PKR bank account, you might see a ~3% conversion margin.

ATM / Card Withdrawals

- Using a Mastercard for ATM withdrawals: USD 3.15 per withdrawal + up to 3% foreign transaction fee, when applicable.

Currency Conversion / Cross-Border Fees

- For transactions involving currency conversion, it applies a mark-up. Their published max is up to 3.5% above base rate.

- On certain internal conversions (between currencies held in your balances), they advertise a low mark-up of 0.5% above the real-time exchange rate for “manage currencies” operations.

Putting It Together: Sample Scenarios

| Scenario | Estimated Fee | Notes |

|---|---|---|

| Withdraw USD balance to USD bank in USA | $1.50 flat | Same-currency, same country withdrawal |

| Withdraw USD to a different currency/local bank | ~2–3 % | Conversion + withdrawal fee |

| ATM withdrawal via Payoneer card (USD) | $3.15 + ~3% | Card + foreign transaction margin |

| Receive cross-border payment (USD) | Up to 1% | Payoneer’s fee for cross-border receiving |

| Currency conversion between balances | ~0.5% | If using “Manage Currencies” feature |

Tips to Minimize Fees

- Keep your balance and bank account in the same currency (if possible) to avoid conversion fees.

- Use bank withdrawals when possible instead of ATM.

- Withdraw larger amounts less frequently (to reduce fixed costs’ impact).

- Check in your dashboard. The “Review” step shows the exact fee before you confirm.

Payoneer vs Competitors: Best Alternatives

When it comes to receiving international payments, Payoneer isn’t the only option. But the big question is: how does it stack up against competitors like PayPal, Airwallex, Wise, or Skrill? Let’s break it down.

Paypal vs Payoneer

- Availability: PayPal isn’t available in many countries (including Pakistan, Bangladesh, and others). Payoneer covers 190+ countries.

- Fees: PayPal often charges 4–5% on international payments once you add withdrawal and conversion costs. Payoneer averages 2–3% for most withdrawals.

- Best For: PayPal is convenient if it’s supported in your country and your clients prefer it. But for freelancers and small businesses where PayPal isn’t available, Payoneer wins hands down.

Payoneer vs Airwallex

- Focus: Airwallex is more tailored to businesses and startups that need multi-currency accounts, corporate cards, and integrations.

- Fees: Airwallex often advertises low FX fees (0.5–1%), which can be cheaper than Payoneer’s 2–3%.

- Best For: If you’re running a global e-commerce brand or company with high-volume transactions, Airwallex can be a strong choice. For freelancers and small agencies, Payoneer is simpler and more widely integrated with platforms like Fiverr and Upwork.

Payoneer vs Wise (formerly TransferWise)

- Fees: Wise is known for its transparent currency conversion at close to mid-market rates + a small flat fee. For sending/receiving one-off payments, it can be cheaper than Payoneer.

- Availability: Wise supports bank-to-bank transfers in 80+ countries, but doesn’t integrate directly with marketplaces like Amazon or Upwork the way Payoneer does.

- Best For: Individuals or businesses who want cheap transfers and don’t rely on marketplaces. If you’re a freelancer working on platforms, Payoneer has the edge.

Skrill vs Payoneer

- Fees: Skrill can be expensive, with currency conversion fees up to 3.99% and ATM withdrawals around $5.50 per transaction.

- Availability: Supports over 200 countries, but not as widely accepted by marketplaces compared to Payoneer.

- Best For: Niche use cases like gaming or gambling sites. For business payments, Payoneer is far more professional and recognized.

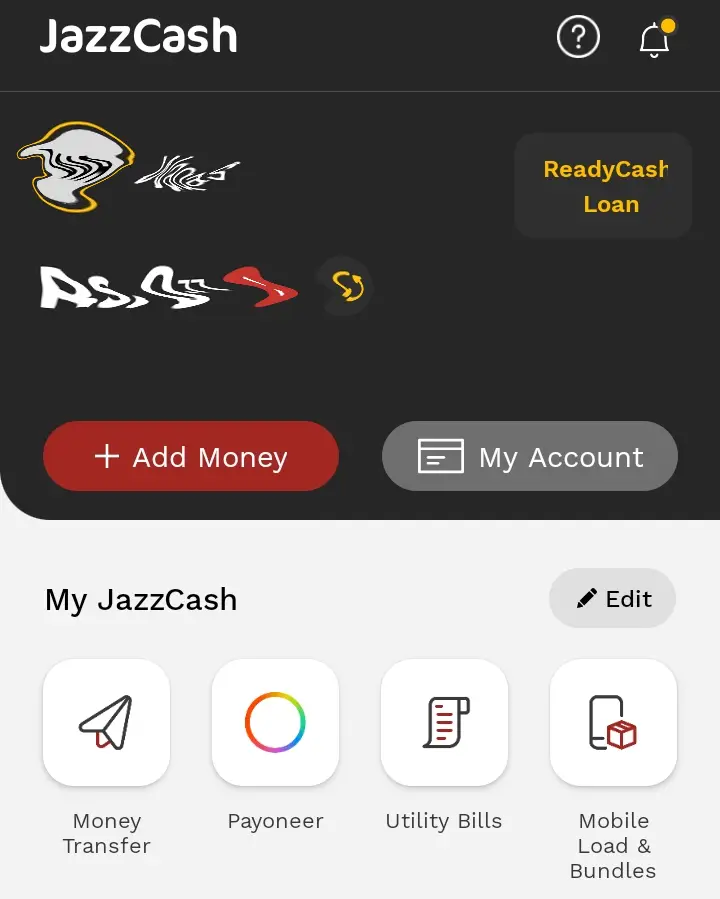

How to Link Payoneer to JazzCash (For Pakistani Freelancers)

One of the biggest wins for freelancers in Pakistan is the ability to connect Payoneer with JazzCash. This means you can receive international payments directly into your JazzCash wallet and then use them locally — no need to always transfer to a bank account.

Here’s how you can set it up:

1: Log in to JazzCash App

Open your JazzCash mobile app and log in with your registered number.

2: Go to Payoneer Integration

- From the main menu, select “Payoneer Account”.

- You’ll see an option to link your Payoneer account.

3: Log in to Payoneer

- Tap the link button, and it will redirect you to Payoneer’s login page.

- Enter your Payoneer email and password, then approve the connection.

4: Confirmation

- Once verified, your Payoneer and JazzCash accounts are officially linked.

- You’ll get a confirmation message in the JazzCash app.

5: Withdraw Funds

Now you can easily move money from Payoneer to JazzCash:

- Go to the JazzCash app.

- Select “Receive from Payoneer”.

- Enter the amount you want to withdraw.

- Confirm the transaction.

Your funds usually show up instantly or within a few minutes.

Why I Recommend Payoneer [My Own Experience]

I had just landed my first international client. I was buzzing, already planning how I’d spend the money. Then they dropped the bomb: “How would you like to get paid?”

And suddenly, my dream gig turned into a nightmare. My local bank? Useless. PayPal? Not even available in my country. Every other option I found looked like a scam straight out of a hacker’s playbook. I almost lost the client before the project even started…not because of my skills, but because I couldn’t figure out how to get paid.

Ridiculous, right?

That’s when Payoneer came in like the hero I didn’t know I needed. Fast sign-up, legit verification, and a working account in days. No shady loopholes. No waiting weeks. Just money arriving where it was supposed to. Honestly, I don’t know if I was more relieved about keeping the client or finally sleeping without stress.

And I’ve been using it ever since. Payoneer lets me hold multiple currencies, withdraw to my bank without daylight robbery fees, and even link it to JazzCash when I need instant access. Compared to PayPal’s daylight robbery fees (when it even exists in your country), it feels like a breath of fresh air.

Wrapping Up: Payoneer Explained

Money delays kill momentum. One late payment can mean missed bills, lost focus, or even losing faith in freelancing. Payoneer cuts the drama.

And here’s a cheeky hack: withdraw on Tuesdays. Mondays are chaos, Fridays get delayed, weekends don’t exist in banking. Tuesdays? Smooth. Thank me later. Go set up your account and stop letting money stress run your calendar.